Overview

With major advancements in its drug pipeline over the last two years, Synthetic Biologics (SYN) has popped on the radar of retail investors, philanthropists and major institutions. Only a year ago, its average share volume stagnated around 50,000 as both analysts and traders alike ignored the company's promising endeavors. However, exceptional investor conference presentations, most notably, the ROTH Conference earlier this month by Chairman and Executive Officer (CEO) Jeff Riley, along with several key data updates and strategic partnership announcements with Intrexon (XON) and Cedars-Sinai have propelled the average share volume to record highs of over one million. Accordingly, the stock price recovered from a low of $.95 in December to a three-year high of $3.20 near the close on March 14.

These historical events have placed Synthetic on the forefront of reinvigorating treatments for life threatening under-treated diseases, including Pertussis and Clostridium difficile (C. Difficile or C. diff). However, its most notable novel treatment is Trimesta, which has proven efficacy in slowing the symptoms of Multiple Sclerosis (MS), and while compelling, we must examine whether it yields the potential to compete with Teva Pharmaceutical's (TEVA) Copaxone, Biogen's (BIIB) Tecfidera, and Novartis' (NVS) Gilenya.

Trimesta Background

Mr. Riley's esteemed approach of developing "sexy drug candidates"(that is, innovative drug candidates that seek to revamp the treatment of infectious and genetic diseases) compliments the fact that Synthetic's primary drug candidate, Trimesta, has proven efficacy when implemented in conjunction with Teva's Copaxone drug. Summarizing the clinical findings of Dr. Rhonda Voskuhl, Clinical Director of Synthetic's Trimesta trials, there is no longer a question of whether Trimesta is effective in reducing symptoms of MS in conjunction with Copaxone.

Through extensive trials, Dr. Voskuhl has proven that the drug is capable of restoring estriol in women who may lack optimal levels after taking contraceptives. It also helps that Trimesta has been used for four decades, but simply lacks approval by the FDA. Moreover, Dr. Voskuhl's examination of subjects treated with Trimesta/Copaxone combination demonstrated its effectiveness in slowing the progression of MS symptoms in women, with a calculated 80% reduction of brain lesions. Dr. Voskuhl also found that the drugs possess healing components which help regenerate the myelin sheath. For those who are not aware of the significance of this unexpected finding, it is imperative to note that MS is induced by damage to the myelin sheath. Therefore, the capacity of the drugs to regenerate the myelin sheath (a process known as remyelination) is paramount since it may indicate that a potential cure for MS is within reach.

In layperson's terms, picture the myelin sheath as the wire of a power cord. When the rubber protecting the wire gets stripped, the wire cannot conduct as well. Likewise, deterioration of myelin (the protective outer-layer of the myelin sheath) inhibits neurological functions, including cognition and motor control. The regeneration of myelin reverses this debilitating process.

Dr. Voskuhl plans to report topline results next month and a detailed analysis of these findings in the second half of 2014.

Drug Advertisement

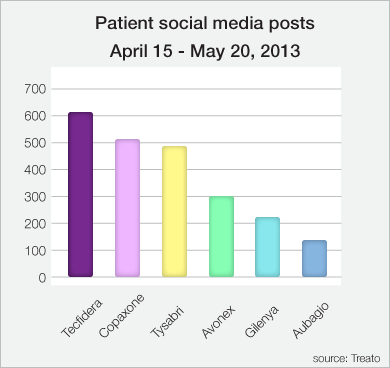

The apparent risks to marketing Trimesta are extensive. Primarily, Synthetic has a serious disadvantage to its aforementioned Big Pharma competitors in the drug advertisement space. As any pharmaceutical company would acknowledge, a drug is only as successful as the management's ability to advertise it to consumers. Failure to sustain optimal media coverage of a drug causes its sales to stagnate regardless of its effectiveness in treating a disease. In order to evaluate the scope of Synthetic's disadvantage in this regard, please observe the following graph of social media utilization:

We can see from above that without serious advertisement efforts, the company might struggle to attract patients with Trimesta. Precisely, Biogen already has a massive lead when it comes to patients spreading the word about their drug, Tecifidera, with over 600 social media posts mentioning it over a one-month period alone. Teva's Copaxone follows in second with over 500 posts, while Novartis' Gilenya struggles to make waves with MS patients as it slumbered around the 200-post mark as of last year.

Since Trimesta is still in clinical trials, it's difficult to project where it would sit on this chart, but given the fact that the already-established drugs in the MS space are somewhat homogenized in terms of how they're administered and frequency of treatment, we believe that substantial media coverage of Trimesta may take less time than some might expect. Case in point, Trimesta is oral estriol which does not require weekly or monthly injections (or infusions) on a continuing basis. Used in conjunction with Copaxone, which is administered via injection, Trimesta would join only three other oral MS drugs, Tecifidera, Gilenya and Aubagio. With more patients transitioning to Tecifidera (yielding a market share of 4% as of last year), compared to both Gilenya and Aubagio (which stagnate around 1% market share), there is plenty of attention on Synthetic's upcoming Trimesta Phase II Topline announcement on April 29th; enough so for the drug to surpass Gilenya and Aubagio in the MS market share for oral pills upon FDA approval given the ongoing success of Copaxone.

Competing Drug Profiles

Biogen's Tecifidera is on the verge of blockbuster status and has left Novartis' Gilenya and Sanofi's (SNY) Aubagio competing for sales scraps. Nevertheless, there are important reasons for the this disparity among oral MS drugs. First, Gilenya has side effectsranging from liver enzyme elevations (which may lead to liver disease), and heart rate reduction. In fact, some patients taking the drug abruptly died upon its arrival to the market. As a result, Novartis relabeled the drug after these patient deaths fostered an unwavering stigma among physicians. Ever since, the drug's market share has been limited by that stigma despite the company's relabeling efforts and the fact that it is not prescribed to patients with specific heart conditions or those taking certain heart medications. In regard to Sanofi, patients taking Aubagio are deterred from practicing contraception because the drug may lead to birth defects and adverse affects on the sperm. While the drug didn't prompt a similar stigma to that of Gilenya, its these side affects seem unattractive enough to place both in the same boat.

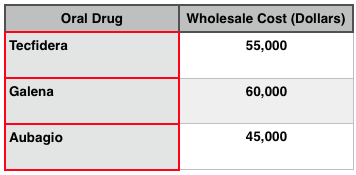

Tecifidera holds a clear advantage over both drugs due to its active ingredient, which has nearly a 20-year history of treating psoriasis in Germany. As a result, physicians are more inclined to prescribe it over Aubagio and Gilenya at a rate of 65%, versus 33% and 53%, respectively. In terms of cost, Tecifidera fairs well against its competitors as seen in the table below:

Noted: The drug cost to patients will vary depending on the insurance coverage that they have.

While it is suprising that Aubagio costs less than its competitors and yet its sales do not match those of its competitors, we attribute the its misfortune to the apparent risks associated with taking it while practicing contraceptives. Also, the efficacy of Aubagio does not meet that of Tecfidera, which some predict will acquire two out of every five dollars of sales outside of the US market. Nevertheless, all three oral MS drugs are expensive, and while there is significant cost variation among them, it is fairly arbitrary relative to other non-oral applications.

The Trimesta Advantage

Regardless of partnering with a major player, e.g., Intrexon or Teva, Synthetic wouldn't have a hard time garnering favor of Trimesta among healthcare providers. While Trimesta has been used for as long as four decades, Copaxone, Teva's non-oral MS drug, thrives with over 25% market share. Of course, this is expected to decline dramatically following the loss of its patent protection in April, and with Synthetic holding numerous patents (U.S. Patent 8,658,627, as well as U.S. Patents 8,372,826 and 6,936,599), we suspect that many of those lost drug sales will fall in the hands of this small biotech company. Given that Copaxone is an FDA-Approved drug that currently dominates the market share of MS, we expect that optimal insurance coverage and healthcare favoring of Trimesta/Copaxone treatment would require little effort by Synthetic's management.

The Risk

As Synthetic lacks the financial resources and manpower to commercialize its drug, and with only an approximated $140 million market cap as of March 18, any attempt towards commercializing Trimesta would most certainly require significant share dilution way beyond its 13$ million stock offering last December. That is, of course, if the Phase II Trimesta data is positive, otherwise the conversation of commercializing the drug is pointless.

We must also consider the potential that the amount of patients transferring over to Teva's 40 mg, thrice-weekly Copaxone drug is of relevant concern to any talk of a potential Synthetic buyout or partnership. We found an interesting report that suggests an approximated 40% of patients will transition from the original Copaxone drug to this new third-generation product. If true, Synthetic's Trimesta/Copaxone drug treatment might fail to significantly detract from the sales of Teva's new product. Consequently, Synthetic may end up having to grab the bull by the horns in terms of facing off against pharmaceutical giants within the MS space. This is an extremely difficult task for a company that has never put a drug on the market. Needless to say that this analysis doesn't even include other companies, including Novartis and Momenta Pharmaceuticals (MMNTA), which plan on commercializing generic versions of Copaxone when its patent protection expires in April. Clearly, the overall competition within the space has become increasingly tenser with the inclusion of these major players.

Bottom Line

Ultimately, we believe that Trimesta has the potential to claim a significant percentage of MS market share from Teva, Novartis and Biogen. While the upcoming data reading will ultimately determine the drug's future, we expect that Synthetic's outstanding management team and extensive pipeline, as well as its strong institutional support (approximately 60 percent) should facilitate the appreciation of shareholder value regardless of Trimesta's fate. Nevertheless, biotech investments have inherent risks. While we hope that this article enables our readers to make informed decisions whether or not to initiate a position in the company, they must also determine whether taking a contrarian approach is financially sound.

Happy trading...

Disclosure: I am long SYN.

No comments:

Post a Comment